Money and Pensions Service have published their report Mapping the unmet need for debt advice in the UK

The South East experiences one of the highest levels of overall unmet demand for face-to-face debt advice services in the UK. Demand exceeds supply in almost all local authority areas in the South East, with the exception of the Isle of Wight, where face-to-face supply exceeds demand. The proportional unmet demand is the highest in Rushmoor, where current supply of face-to-face services could meet only fourteen percent of demand. Southampton experiences the largest gap between face-to-face supply and demand by volume.

People in the UK continue to struggle with debt. We estimate that around nine million people are over-indebted, i.e. they find keeping up with payments a heavy burden or have fallen behind on, or missed, payments in any three or more months in the last six months.

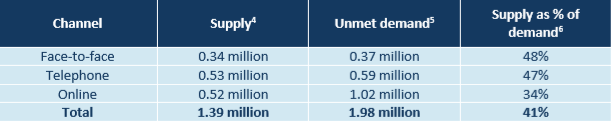

The overall picture of debt advice in the UK is of high levels of unmet demand. Demand continues to exceed the supply of debt advice, and we estimate that the overall unmet demand in the UK is nearly two million clients.

Face-to-face is the channel with the smallest gap between demand and supply at the national level. Nevertheless, the levels of unmet demand are high, with demand being over two times higher than supply. It is also the channel with the biggest variation in unmet demand between countries and regions. Face-to-face unmet demand is particularly high in London, where existing supply of face-to-face debt advice could meet only just over a fifth of current demand.